Alright, let’s get straight to it. You’ve probably seen the term Damlpips floating around forums, blogs, or crypto trading corners of the internet and thought, “Okay… but what exactly is this thing?” I had the same reaction the first time. Curiosity kicked in, coffee followed, and down the rabbit hole I went.

So let’s talk about what Damlpips actually is, why people care, and whether it deserves your attention or just another eye roll. Spoiler alert: it’s way more interesting than it sounds.

Contents

- 1 So, What Is Damlpips Really?

- 2 Why the Name “Damlpips” Makes Sense

- 3 Why Damlpips Even Exists

- 4 How Damlpips Works (Without the Headache)

- 5 Key Features That Make Damlpips Stand Out

- 6 Damlpips vs Traditional Trading Systems

- 7 Real World Use Cases of Damlpips

- 8 Why Developers Like Damlpips

- 9 Damlpips and Python: A Friendly Combo

- 10 Security: Does Damlpips Hold Up?

- 11 Is Damlpips Beginner-Friendly?

- 12 Common Misconceptions About Damlpips

- 13 Pros and Cons of Damlpips

- 14 Where Damlpips Fits in the Future

- 15 Should You Care About Damlpips?

- 16 Quick Takeaways Before We Wrap Up

- 17 Final Thoughts

So, What Is Damlpips Really?

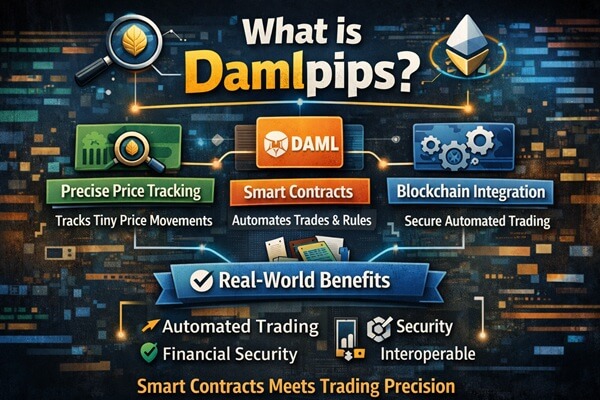

At its core, Damlpips blends financial precision with smart contract automation. Think of it as a meeting point where trading accuracy shakes hands with blockchain logic.

Damlpips takes the classic idea of pips those tiny price movements traders obsess over—and plugs them into DAML-based smart contracts. That combo lets systems track micro price changes and act on them automatically. Sounds fancy, but it’s actually pretty practical.

Ever wondered why tiny price movements matter so much in trading? Yeah, this is exactly where Damlpips shines.

Why the Name “Damlpips” Makes Sense

Let’s break the word apart without getting nerdy.

DAML Part

DAML (Digital Asset Modeling Language) helps developers create secure, rule-based smart contracts. DAML focuses on clarity, automation, and trust.

Pips Part

A pip measures the smallest price movement in trading. Forex traders live and breathe this stuff.

Put Them Together

Damlpips = ultra-precise price tracking + automated smart contracts.

Simple idea. Powerful execution.

Why Damlpips Even Exists

Let’s be honest traditional trading systems struggle with speed, transparency, and automation. Manual checks slow things down. Human error sneaks in. Trust issues pop up.

Damlpips steps in to fix that mess by:

-

Automating financial logic

-

Reducing manual intervention

-

Improving price accuracy

-

Creating trust through code

IMO, that alone makes it worth paying attention to.

How Damlpips Works (Without the Headache)

You don’t need a PhD for this part, I promise.

The Basic Flow

Here’s what typically happens:

-

The system tracks price movements in pips

-

Smart contracts define rules and triggers

-

When conditions match, the system executes automatically

-

Everything records securely on a ledger

No guessing. No delays. No “Did that actually go through?” moments.

Ever wished trading felt less stressful? Yeah, automation helps.

Key Features That Make Damlpips Stand Out

Let’s talk features, because this is where things get interesting.

1. Precision Price Tracking

Damlpips focuses on tiny price changes, not just big swings.

That helps with:

-

High-frequency trading

-

Risk management

-

Fine-grained analytics

When cents matter, precision wins.

2. Smart Contract Automation

Damlpips uses predefined rules written into smart contracts.

That means:

-

Trades execute automatically

-

Conditions enforce themselves

-

No emotional decision-making

I love this part. Computers don’t panic. Humans do.

3. Transparency and Trust

Every action leaves a clear, verifiable record.

You get:

-

Fewer disputes

-

Better audits

-

More confidence

Ever questioned a transaction result? This fixes that.

4. Cross-Platform Flexibility

Developers can integrate Damlpips across different ledger systems.

That flexibility makes it appealing for:

-

Institutions

-

Developers

-

Hybrid trading platforms

One system, multiple environments. Clean and efficient.

Damlpips vs Traditional Trading Systems

Let’s compare real quick, because context matters.

Traditional Systems

-

Manual oversight

-

Slower execution

-

Human errors

-

Limited transparency

Damlpips-Based Systems

-

Automated logic

-

Faster execution

-

Code-enforced rules

-

Transparent records

Which one would you trust with real money? Exactly.

Real World Use Cases of Damlpips

This isn’t theory-only stuff. People actually use it.

Digital Asset Trading

Traders use Damlpips to:

-

Monitor micro price movements

-

Trigger automated trades

-

Manage risk precisely

When markets move fast, reaction time matters.

Institutional Finance

Institutions love structure, and Damlpips delivers.

They use it for:

-

Automated settlements

-

Compliance enforcement

-

Transparent workflows

Less paperwork. More reliability.

Smart Contract Workflows

Damlpips doesn’t stop at trading.

It also supports:

-

Automated approvals

-

Conditional asset transfers

-

Financial reporting logic

Ever thought contracts should “just work”? That’s the idea.

Why Developers Like Damlpips

Developers don’t chase hype. They chase tools that work.

What Developers Appreciate

-

Clear logic structures

-

Reusable contract templates

-

Predictable behavior

-

Easier debugging

As someone who’s broken enough code to learn humility, I respect anything that reduces chaos.

Damlpips and Python: A Friendly Combo

Python developers often integrate Damlpips logic into backend systems.

Why Python Fits Well

-

Clean syntax

-

Strong financial libraries

-

Easy automation support

Python handles the logic layer while DAML manages contract enforcement. Nice balance, right?

Security: Does Damlpips Hold Up?

Short answer: yes.

Security Advantages

-

Rule enforcement through code

-

Limited attack surface

-

Reduced human interference

-

Transparent execution paths

Security improves when systems remove guesswork. Damlpips does exactly that.

Is Damlpips Beginner-Friendly?

Honestly? Yes and no.

Easy Parts

-

Conceptual understanding

-

Clear use cases

-

Logical workflows

Learning Curve Areas

-

Smart contract syntax

-

Ledger integration

-

Financial logic modeling

If you already understand trading basics, you’ll adapt quickly.

Common Misconceptions About Damlpips

Let’s clear some myths before they spread further.

“It’s Just a Buzzword”

Nope. It solves real problems.

“Only Big Institutions Can Use It”

Wrong. Developers and startups explore it too.

“It Replaces Traders”

Relax. It supports traders—it doesn’t replace them.

Pros and Cons of Damlpips

Nothing stays perfect, so let’s stay honest.

Pros

-

High precision

-

Automation

-

Transparency

-

Scalability

Cons

-

Learning curve

-

Setup complexity

-

Requires proper planning

Still worth it? IMO, yes.

Where Damlpips Fits in the Future

Automation keeps growing. Financial systems keep evolving. Damlpips fits neatly into that trend.

I expect more:

-

Hybrid trading platforms

-

Automated compliance tools

-

Smart financial workflows

Ever notice how finance keeps leaning into automation? This feels like the next step.

Should You Care About Damlpips?

Ask yourself:

-

Do you care about precision?

-

Do you value automation?

-

Do you trust code more than emotion?

If you said yes even once, Damlpips deserves a look. FYI, ignoring this shift might feel risky later 🙂

Quick Takeaways Before We Wrap Up

Let’s recap without dragging this out.

-

Damlpips combines pip-level precision with smart contracts

-

It automates trading and financial workflows

-

It improves transparency, speed, and trust

-

It supports developers, traders, and institutions

Not bad for a concept that sounds confusing at first, right?

Final Thoughts

Damlpips doesn’t try to reinvent finance. It tightens the screws, removes friction, and lets systems behave logically. I respect tools that solve real problems without screaming for attention.

If you enjoy clean automation, precise data, and fewer surprises, you’ll probably like Damlpips. And if nothing else, at least now you won’t wonder what the term means when it pops up again.